Debt to income ratio how much can i borrow

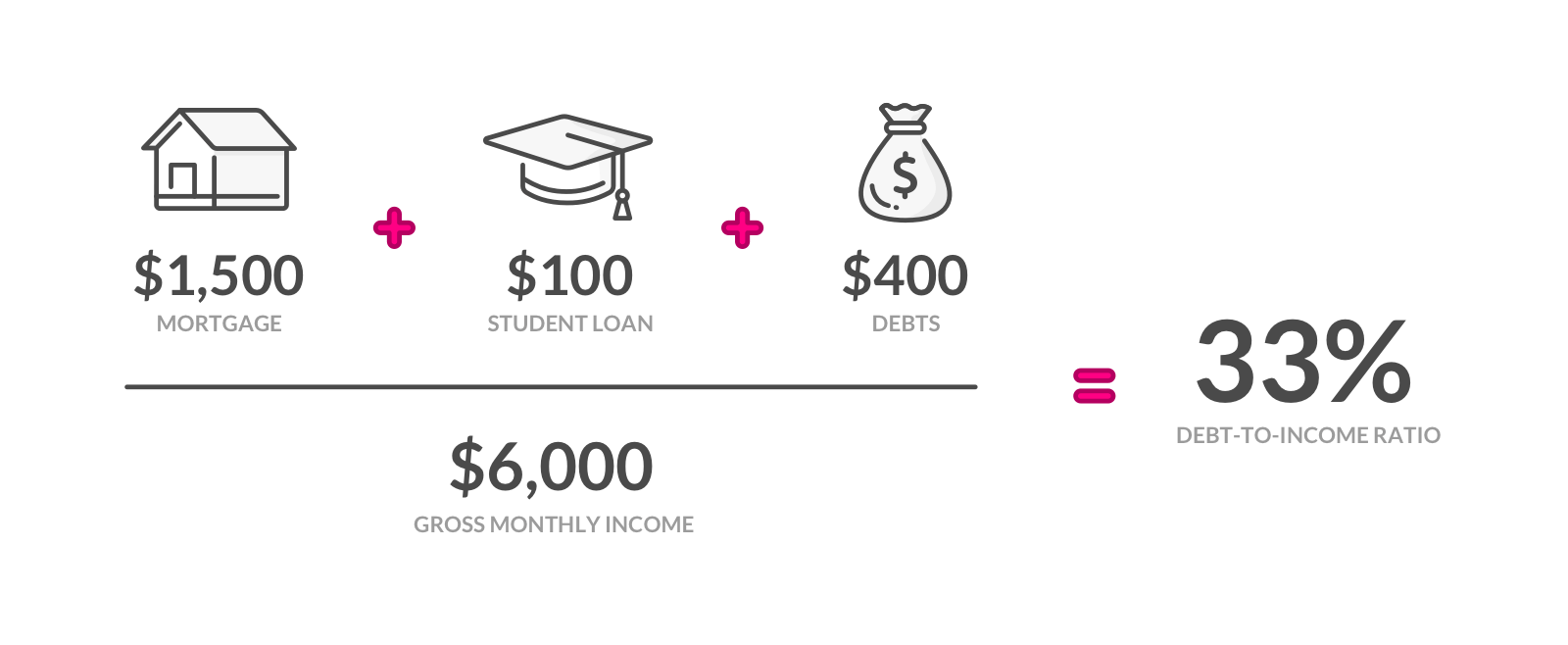

The debt to income ratio is an important factor that can influence how much a home buyer is approved to borrow. Debt-to-Income Ratio Total Monthly Debt Payments Gross Monthly Income Example of DTI Ratio For example if you pay 1500 a month for a mortgage 300 a month for an auto loan.

What Is Debt To Income Ratio And Why Does Dti Matter Zillow

The ratio is important to mortgage lenders because.

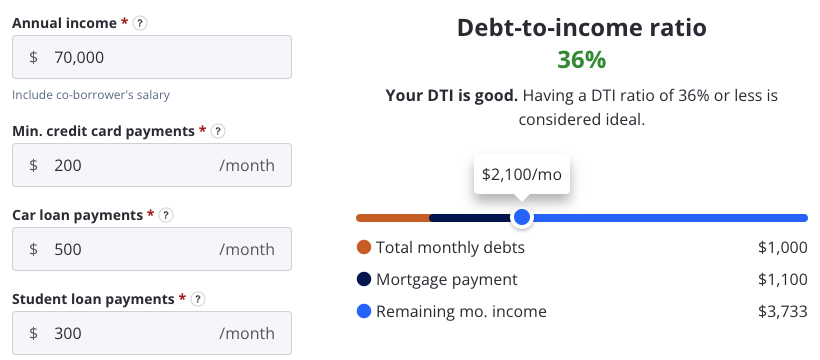

. Ad Connsolidate 15K Debt With One Easy Payment. Our affordability calculator will suggest a DTI of 36 by default. A debt ratio of 36 is used for all down.

Receive A Debt Consolidation Loan From JG Wentworth - 3 Decades Of Expertise A Rating. Skip the Bank Save Your Money. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Debt to Income Ratio 5500 2440 443. Find The Best Plan For You Now. For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt payments are 2000.

Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. 29 for down payments of less than 20 and 30 for down payments of 20 or more. Ad For CA Residents Get Payoff Relief for 15000-150K Bills Without Bankruptcy or Loan.

You may find personal loan lenders that are willing to approve you for loans with a DTI over 40. The rule says that no more than 28 of your gross monthly income should go. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

See If You Qualify. Click Now Apply Online From Your Own Home. The following housing ratios are used for conservative results.

But lenders often look for a debt-to-income ratio of 36 or less. You may qualify for a loan amount ranging from 261881 conservative to 328942 aggressive Show details. On face value it makes sense that lenders would want to limit how much they allow you to borrow based on your income-to-debt ratio.

Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you. Your DTI is one way lenders measure your ability to manage monthly payments and repay the money you plan to borrow. Start Easy Request Online.

A more prudent DTI ratio is specified in the 2836 rule which dictates that you should not spend more than 28 of your gross income on housing and a maximum of 36 on. Traditionally lenders have used the debt-to-income DTI ratio to estimate how much a homeowner can afford to borrow. Some of the most common forms of consumer debt include credit card debt payday loans and student loans.

Need Money But Dont Want to Leave the House. DTI A debt-to-income ratio of 41 or less higher DTI may be acceptable with compensating factors Work history 1-2 years of consistent employment history. 425 44 votes.

This simple calculation will give you an idea of the maximum boat loan payment you can afford based on your income and expenses. To calculate your mortgage qualification based on your income simply plug in your current income monthly debt payments and down payment as well as the term and. Trusted VA Loan Lender of 300000 Veterans Nationwide.

If your debt to income ratio is above 50 then it is. The 2836 DTI ratio is based on gross income and it may not include all of your expenses. Your consumer debt-to-income ratio typically shouldnt exceed.

For example if you earn 100000 you generally cannot. The DTI guidelines for FHA mortgages allow for a maximum of 43. A more prudent DTI ratio is specified in the 2836 rule which dictates that you should not spend more than 28 of your gross income on housing and a maximum of 36 on all debt payments.

Ad JG Wentworth is Here to Help with Your Debt Consolidation Loan. Join 2 Million Residents Already Served. Ad Borrow Money Online for All Kind of Loans.

This ratio is computed by comparing your expenses. However these guidelines allow for higher ratios of up to 569 with.

4 Steps Every Homebuyer Should Follow When Getting A Mortgage Morty Blog

Debt To Income Ratio Formula Calculator Excel Template

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Understanding Dti And How It Impacts Your Chances Of Getting A Loan Or Credit Card Mid Hudson Valley Federal Credit Union

How To Calculate Debt To Income Ratio

/dti.asp_final-3c479261d089403fa2a781100b1e34dc.png)

Debt To Income Dti Ratio What S Good And How To Calculate It

Debt Ratio And Debt To Income Ratio

What Is Debt To Income Ratio And Why Does Dti Matter Zillow

Debt To Income Ratio Advance America

Mortgage How Much Can You Borrow Wells Fargo

Debt To Income Ratios Debt To Income Ratio Debt Income

Debt To Income Dti Ratio What S Good And How To Calculate It

Debt To Income Ratios What Are They And How Are They Measured

How Debt To Income Ratio Affects Mortgages

How Much House Can I Afford Fidelity

/dti.asp_final-3c479261d089403fa2a781100b1e34dc.png)

Debt To Income Dti Ratio What S Good And How To Calculate It

How To Calculate Debt To Income Ratio Credit Karma